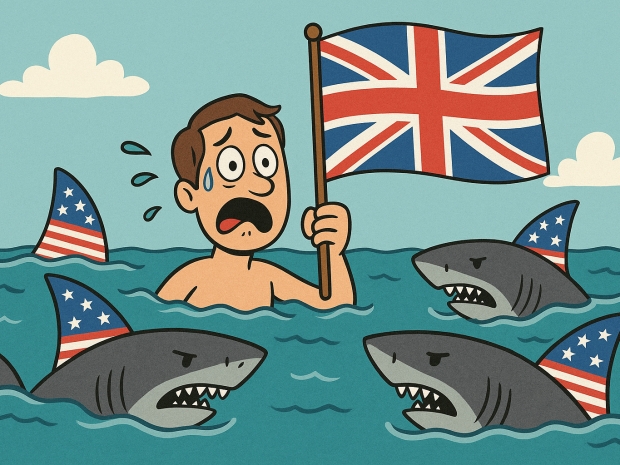

London-listed Alphawave, which admitted it was waving the white flag in a $2.4 billion (£1.8 billion) cash-and-shares deal with American chip behemoth Qualcomm. The move means yet another UK semiconductor firm will be flying the stars and stripes.

Not to be outdone, quantum computing outfit Oxford Ionics inked a $1.1 billion pact with IonQ, despite having raised just £30 million in 2023 and sporting a valuation unlikely to have scraped £200 million.

Then the precision equipment maker Spectris caused a stir after it confirmed a £3.7 billion bid from US private equity spivs at Advent. Spectris management hinted they were warming to the idea, which sent shares through the roof.

The combined £6.3 billion in takeovers sent another worrying signal that UK tech remains on permanent discount, with the cocaine nose jobs of Wall Street all too happy to scoop up the inventory.

Alphawave’s 183p-a-share price nearly doubled its recent trading level, Spectris saw a premium of more than 60 per cent, and Oxford Ionics was valued at a figure miles beyond its last funding round.

The timing could not have been worse for PM Keir Starmer, who had only just finished shaking hands and name-dropping Nvidia’s Jensen Huang at London Tech Week.

AJ Bell head of financial analysis Danni Hewson said, “Today has delivered a double blow for London markets.”

“Whether or not the writing was on the wall from the start after Alphawave’s discouraging IPO, this is exactly the kind of tech company that the UK struggles to support and exactly the kind of company the UK needs to thrive. Considering that its US suitor has agreed to pay handsomely for the company, it’s clearly a business that has value to Qualcomm and its plans to expand data centres,” she said.

“Many UK companies still look cheap and that’s likely to keep the takeover offers coming,” Hewson said.